Listen to this blog

Discover how AI data integration streamlines the mortgage lending landscape, enhances accuracy, and boosts customer satisfaction thereby transforming challenges into business success.

Introduction

The financial services sector, which is at the heart of global economic stability, is currently undergoing a fundamental transformation due to the adoption of Generative AI, particularly in mortgage lending. According to a recent research, the AI industry in banking is expected to reach $64.03 billion by 2030, with a compounded annual growth rate (CAGR) of 38% beginning in 2020. This spike demonstrates AI's transformational power in reinventing traditional methods, offering improved operational efficiency, precision, and client satisfaction.

In mortgage lending, AI is transitioning from a futuristic idea to a practical tool for managing complex transactions, evaluating risks, and personalizing customer interactions. Despite its rapid progress, AI brings challenges such as ethical concerns, regulatory compliance, and the risk of algorithmic bias, which can exclude ’credit invisible’ individuals without traditional credit histories. Incorporating additional information beyond traditional credit scores into AI can help accurately assess creditworthiness.

This blog highlights the aforementioned challenges while stressing the importance of balancing technological benefits with thoughtful implementation.

The problem

The key challenges in mortgage lending

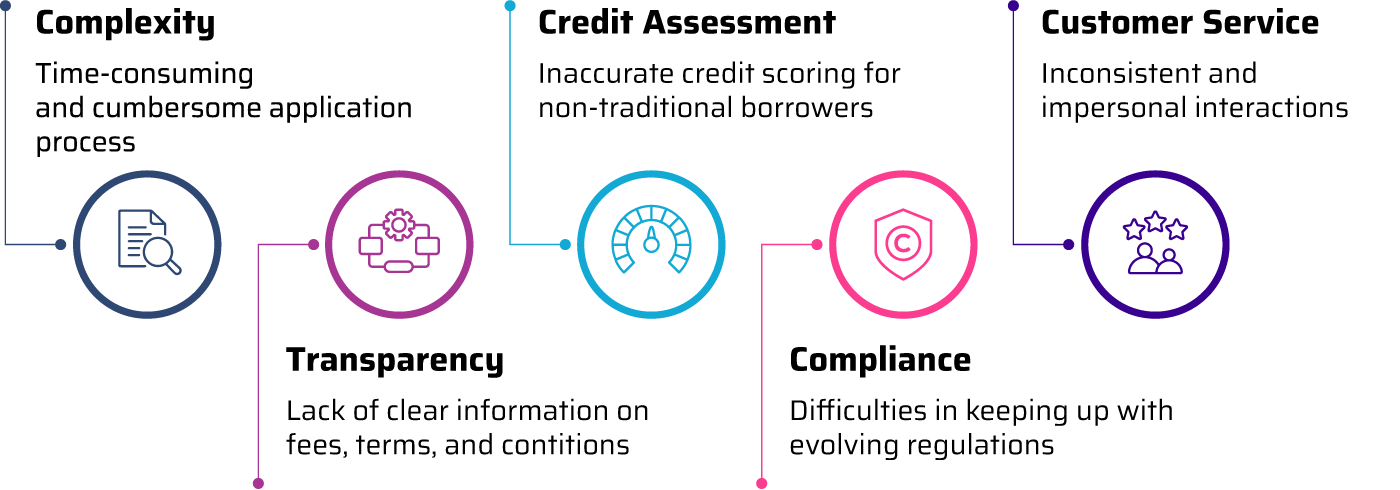

The mortgage industry faces several key challenges that need to be addressed to enhance service offerings and enhance customer experience. One major challenge is the complexity of the mortgage application process - Customers often find the process cumbersome and time-consuming, as it requires extensive documentation and multiple interactions with lenders and other stakeholders. This complexity can lead to delays and frustration, deterring potential borrowers. To improve the customer experience, lenders must streamline the application process by leveraging technology such as automated document collection and verification systems, which can significantly reduce processing time and enhance accuracy.

Another significant challenge is the lack of transparency in the mortgage lending process. Borrowers frequently struggle to understand the various fees, terms, and conditions associated with their loans, leading to confusion and mistrust. Lenders can address this issue by providing clear, concise information and utilizing digital tools that offer real-time updates and explanations. Enhanced transparency can build trust and improve customer satisfaction, fostering long-term relationships between borrowers and lenders.

Credit assessment is another area that presents challenges. Traditional credit scoring models may not accurately reflect a borrower’s true creditworthiness, especially for those with non-traditional income sources or limited credit history. This can result in deserving applicants being denied loans or offered unfavorable terms. Lenders can develop more comprehensive and accurate credit assessment models by incorporating alternative data sources and advanced analytics. This approach can help identify creditworthy borrowers who might otherwise be overlooked, expanding access to mortgage financing and improving customer inclusivity. Furthermore, the mortgage lending industry grapples with the complexities of regulatory compliance. The ever-evolving regulatory landscape requires lenders to constantly update their practices to ensure compliance, which can be resource-intensive and complex. Non-compliance can lead to hefty fines and damage to reputation. To mitigate these risks, lenders can invest in robust compliance management systems that automate monitoring and reporting, ensuring adherence to regulations while minimizing operational disruptions.

Customer service is another critical area that requires improvement. Inconsistent communication and lack of personalized service can leave borrowers feeling neglected and dissatisfied. Implementing customer relationship management (CRM) systems can help lenders provide more personalized and responsive service. These systems can track customer interactions, preferences, and feedback, enabling lenders to tailor their services to individual needs and enhance overall customer experience.

To sum up the challenges, the integration of digital technologies presents both a challenge and an opportunity. While adopting new technologies can improve efficiency and customer satisfaction, it also requires significant investment and change management. Lenders must carefully plan and execute digital transformation strategies to ensure seamless integration and avoid disruptions to existing operations

The solution

Benefits of AI in mortgage lending

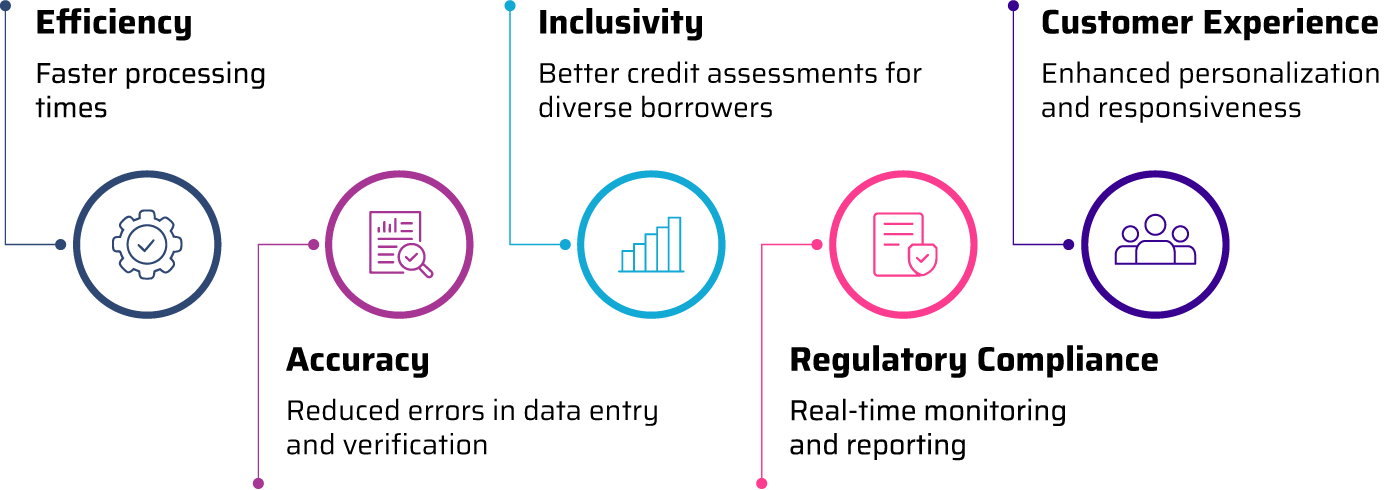

Artificial Intelligence (AI) holds immense potential in addressing the fundamental challenges of the mortgage industry, thereby improving service offerings and meeting customer expectations more effectively. One of the primary issues in mortgage lending is the complexity and lengthiness of the application process. AI can streamline this process by automating document collection and verification. Through Natural Language Processing (NLP) and machine learning algorithms, AI can quickly analyze and validate vast amounts of documentation, significantly reducing processing times and minimizing human error.

Furthermore, AI-powered technologies simplify the mortgage application process by automating typical tasks like document verification and data entry. Optical Character Recognition (OCR) technology, for example, turns scanned documents into machine-readable formats, increasing data accuracy and lowering human error. This automation not only reduces processing hours but also increases client satisfaction by offering faster responses to loan applications.

Ensuring openness is another major difficulty in mortgage lending. To navigate that, AI-powered chatbots and virtual assistants may deliver real-time updates, explanations, as well as clear and precise information suited to specific requests. These AI tools streamline the mortgage process, increase trust, and improve customer satisfaction by keeping borrowers informed at all stages.

One key use of AI in the mortgage lending industry is to improve the efficiency and accuracy of loan underwriting. AI algorithms use massive volumes of borrower data, such as credit history, income sources, and financial activities, to forecast creditworthiness more precisely than traditional techniques. This not only accelerates the approval process but also lowers the risk of default by identifying prospective high-risk loans early on.

Furthermore, AI is critical for fraud detection and risk management. Machine learning algorithms can identify irregularities in financial documentation and transaction patterns, indicating probable fraud or noncompliance with regulatory norms. In essence, artificial intelligence is altering mortgage lending by improving efficiency, accuracy, and responsiveness to client needs, ultimately leading to a more streamlined and secure financial environment.

While the integration of digital technologies presents challenges, AI offers a strategic advantage in digital transformation. AI-driven solutions can seamlessly integrate with existing systems, enhancing operational efficiency without causing major disruptions. By investing in AI, lenders can overcome the hurdles of technology adoption, ensuring a smooth transition and maximizing the benefits of digital innovations.

Conclusion

Addressing these pivotal challenges is essential for mortgage lenders seeking to elevate their service standards. By streamlining operations using AI, mortgage providers can create a more efficient and customer-focused lending mechanism, increasing transparency, refining credit evaluations, and maintaining regulatory compliance.

With this objective in mind, Visionet is committed to providing end-to-end mortgage solutions through our specialized four-stage process enhancement framework (AMIM) that guarantees a seamless and faster mortgage journey, encompassing onboarding, processing, valuation, title settlement, and servicing.

Transform your mortgage process with Visionet’s AI-powered solutions. Contact us today to get started!