Listen to this blog

The mortgage lending industry is rapidly evolving, driven by increasing borrower expectations and heightened competition. Omnichannel strategies are reshaping the way lenders engage with borrowers by providing a seamless, integrated experience across digital and in-person platforms. Unlike fragmented multichannel approaches, omnichannel lending ensures cohesive and personalized interactions, enhancing borrower satisfaction and loyalty.

This blog delves into the advantages of adopting omnichannel solutions, demonstrating how they outperform traditional methods by streamlining processes, improving efficiency, and fostering stronger customer relationships. Backed by real-world examples and practical insights, we’ll explore how this approach equips lenders to thrive in today’s dynamic market and secure long-term success.

How omnichannel lending outperforms traditional multi-channel models

Omnichannel lending surpasses traditional multi-channel models by delivering a seamless, integrated borrower experience across all platforms. According to a study by the Mortgage Bankers Association, lenders implementing omnichannel strategies have seen a 15% increase in customer satisfaction and a 20% reduction in loan processing times. By unifying digital and in-person interactions, omnichannel lending not only enhances borrower engagement but also streamlines operations, providing a significant competitive edge in the evolving mortgage landscape. By embracing omnichannel solutions, mortgage service providers are not only meeting modern borrower expectations but also gaining a competitive advantage in a rapidly shifting market, positioning themselves as leaders in the industry’s digital transformation.

6 key challenges for lenders transitioning to omnichannel mortgage experiences

Omnichannel lending surpasses traditional multi-channel models by delivering a seamless, integrated borrower experience across all platforms. According to a study by the Mortgage Bankers Association, lenders implementing omnichannel strategies have seen a 15% increase in customer satisfaction and a 20% reduction in loan processing times. By unifying digital and in-person interactions, omnichannel lending not only enhances borrower engagement but also streamlines operations, providing a significant competitive edge in the evolving mortgage landscape. By embracing omnichannel solutions, mortgage service providers are not only meeting modern borrower expectations but also gaining a competitive advantage in a rapidly shifting market, positioning themselves as leaders in the industry’s digital transformation.

Unifying legacy systems into a seamless omnichannel platform is a significant hurdle. The complexity of integration often leads to delays and increased costs, making it a critical challenge for lenders striving to modernize their workflows.

Managing borrower data across various channels heightens the risk of breaches. The Federal Trade Commission reported over $1.6 billion in losses due to mortgage-related identity fraud, emphasizing the urgent need for robust security protocols.

Adhering to evolving regulations across multiple platforms is complex and time-consuming. For lenders, achieving consistent compliance while scaling omnichannel systems remains a top priority to avoid penalties and protect borrower trust.

Delivering a cohesive borrower journey across digital and in-person touchpoints is essential. With 76% of customers expecting a seamless experience, consistency in engagement can lead to satisfaction and attrition.

The shift to an omnichannel strategy requires equipping teams with the skills to operate new technologies and workflows. Resistance to change and a lack of comprehensive training programs can hinder the adoption process.

The upfront costs of transitioning to omnichannel systems can be substantial, making it a significant barrier for some lenders. However, the long-term benefits in terms of efficiency, customer satisfaction, and competitive differentiation often outweigh the initial investment.

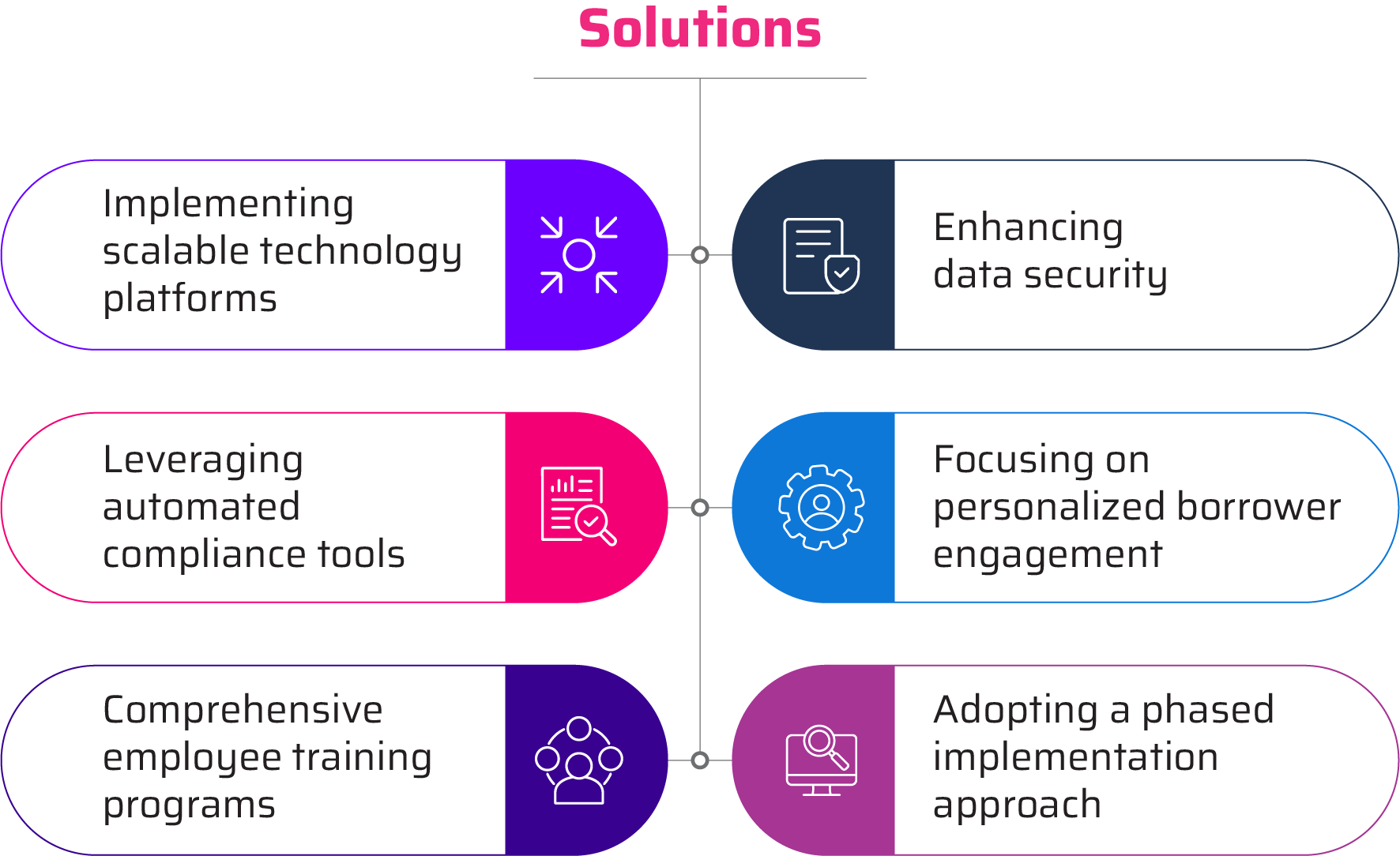

6 effective solutions for lenders transitioning to omnichannel mortgage experiences

To address integration challenges, lenders should adopt scalable, flexible technology platforms that unify disparate systems. These platforms streamline workflows, enable real-time data sharing, and create a cohesive borrower experience.

Deploying advanced encryption protocols and real-time monitoring tools can significantly reduce risks associated with data breaches. By safeguarding borrower information, lenders can build trust and ensure compliance with security regulations.

Integrated compliance tools can track and enforce regulations across all touchpoints, reducing the burden on teams and ensuring consistent adherence to industry standards. This minimizes the risk of penalties and enhances operational reliability.

To deliver consistent customer experiences, lenders can use data analytics and artificial intelligence to personalize interactions across all channels. Tailored communication and proactive updates enhance borrower satisfaction and loyalty.

Invest in structured training programs to upskill employees on omnichannel technologies and workflows. Additionally, foster a culture of adaptability to ease the transition and encourage buy-in across teams.

To manage costs effectively, lenders can implement omnichannel solutions in phases, prioritizing high-impact areas first. This approach ensures a gradual transition with measurable benefits at each stage, reducing financial strain and operational disruption.

Unlocking sustained success with an omnichannel approach

Adopting an omnichannel strategy offers lenders long-term advantages that go beyond immediate operational improvements. This approach fosters resilience in a competitive mortgage market by creating a foundation for adaptability, scalability, and enhanced borrower experiences. By integrating all communication and service platforms, lenders are better equipped to anticipate industry shifts, meet evolving borrower expectations, and maintain relevance in an ever-changing landscape.

Omnichannel systems allow lenders to seamlessly scale operations as borrower demands increase, ensuring consistent service delivery without compromising quality.

Data integration across platforms empowers lenders with actionable insights, enabling them to predict trends and make informed choices that align with market opportunities.

With a unified system, lenders can quickly implement updates, navigate regulatory changes, and adjust to new market dynamics, ensuring they remain ahead of competitors.

Maximizing operational agility with omnichannel strategies

Implementing omnichannel solutions helps lenders develop a flexible and efficient operational structure tailored to the dynamic mortgage industry. By unifying various channels into a cohesive system, lenders can streamline workflows, minimize redundancies, and effectively address borrower needs while adapting to changing market demands.This adaptability is not limited to improving current workflows but also extends to preparing for unforeseen market changes, regulatory updates, and shifting borrower expectations. The proactive approach helps in identifying opportunities for growth and innovation while addressing potential challenges before they escalate. By focusing on agility and strategic alignment, lenders position themselves to thrive in an environment where responsiveness and efficiency are key drivers of success.

Omnichannel platforms ensure seamless integration with external partners, reducing delays and inefficiencies caused by fragmented communication.

Unified systems allow lenders to monitor operational performance and reallocate resources dynamically to address bottlenecks and improve productivity.

Integrated frameworks make it easier for lenders to embrace emerging technologies, enabling them to refine processes and maintain relevance in a competitive market.

Conclusion

As the mortgage landscape continues to evolve, lenders who embrace omnichannel solutions are better positioned to stay agile, meet regulatory requirements, and foster meaningful borrower relationships. The ability to anticipate trends, adapt workflows, and offer consistent, personalized service across all touchpoints ensures a lasting impact on both operational excellence and customer loyalty. With the right vision and execution, lenders can transform challenges into opportunities, setting a new standard for success in the mortgage industry.