Listen to this blog

Introduction

In the mortgage industry, staying competitive requires more than just managing a high volume of loans—it demands a streamlined, efficient process that reduces costs, minimizes errors, and ensures compliance. Automation is key in achieving these goals. By automating critical tasks throughout the mortgage lifecycle —from loan processing and underwriting to post-closing audits—lenders can enhance operational efficiency, reduce turnaround times, and improve data accuracy. In this blog, we will explore the key benefits of automation in mortgage lending, showcasing how it accelerates loan processing, strengthens compliance, reduces costs, and increases scalability. Let’s dive into how automation can optimize your mortgage operations and make your loans more attractive to both borrowers and investors.

Understanding mortgage post-close audits

What happens when a mortgage is finalized? This is where mortgage post-close audits come into play. These essential reviews ensure that all loan documents and processes comply with regulatory standards and industry guidelines. With the mortgage industry facing multiple challenges such as a 57% rise in foreclosure rates, lenders are under greater pressure to conduct thorough post-close audits. By doing so, they can mitigate compliance risks, ensure accuracy, and avoid costly regulatory penalties.

Why are post-close audits required?

Key functions of the post-close audit process

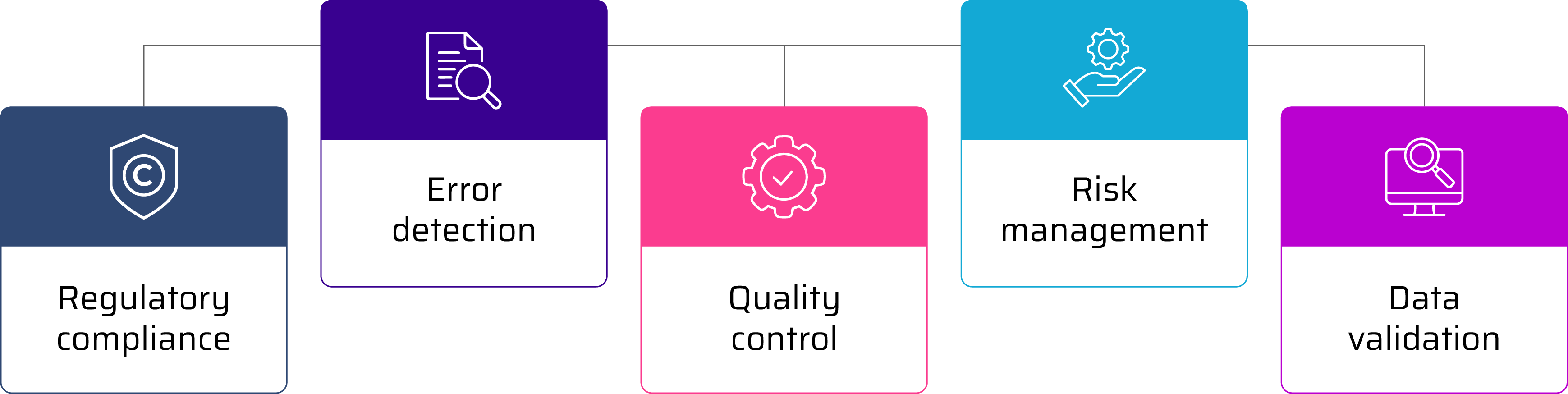

The mortgage post-close audit process plays a crucial role in maintaining compliance, quality, and risk management throughout the loan lifecycle. Here are the key functions it serves:

01 | Regulatory compliance

Post-close audits ensure that all loan documentation complies with federal, state, and investor guidelines. This helps lenders avoid legal issues, penalties, and regulatory non-compliance, ensuring the loan process remains transparent and aligned with industry standards.

02 | Error detection

Thorough post-close audits identify discrepancies or errors that may have occurred during the mortgage process. Detecting and correcting these issues maintain the accuracy and integrity of loan data and documentation.

03 | Quality control

Audit include a comprehensive review of underwriting decisions, appraisals, and third-party data verification. This ensures that all aspects of the loan meet stringent quality standards, instilling confidence in the loan’s soundness and compliance.

04 | Risk management

Following the 2008 financial crisis, lenders have become more cautious in their lending practices. Post-close audits play a vital role in mitigating risks by verifying borrower information, assessing creditworthiness, and aligning loans with risk management protocols.

05 | Data validation

Accurate data is essential for successful mortgage processing. Post-close audits involve systematic verification of borrower information by cross-referencing details from loan applications, closing documents, and credit reports. This rigorous validation process ensures consistency and, reliability, minimizing errors and safeguarding the interests of all parties involved. It reflects the industry's commitment to due diligence and responsible lending practices.

By ensuring these functions are meticulously executed, post-close audits enable lenders reduce risk, stay compliant, and maintain high-quality standards in the mortgage process.

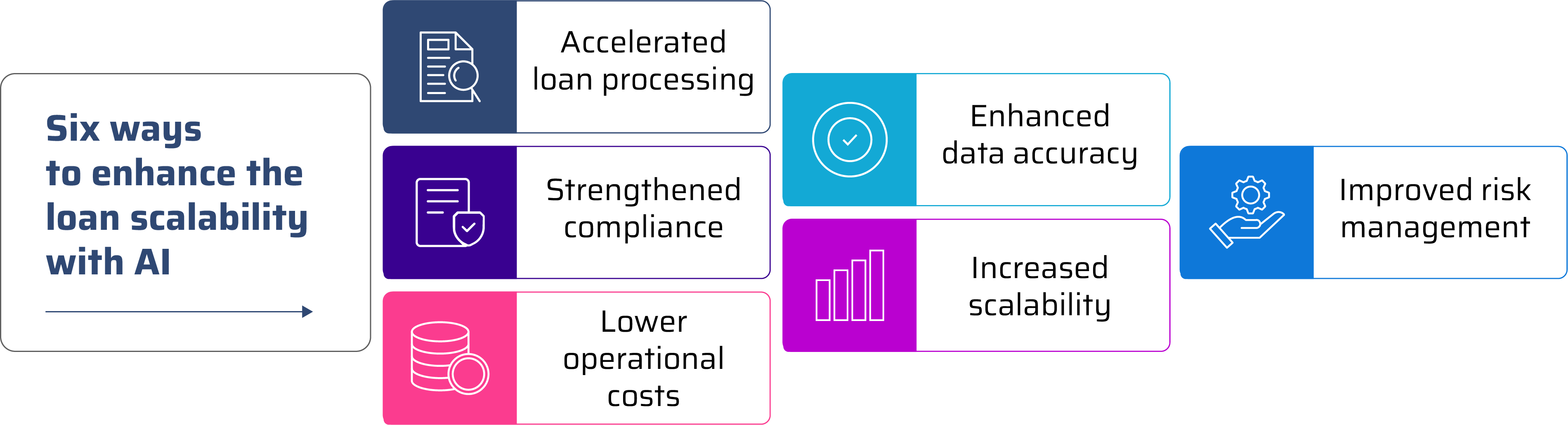

Six ways to Enhance the Loan scalability with the help of Automation

Benefits of automation in mortgage lending

Accelerated loan processing

By automating key processes like document management and underwriting, lenders can speed up loan approvals and closures, enhancing customer satisfaction and boosting repeat business.

Example A regional lender reduced processing time by 30% after automating critical tasks, allowing them to close more loans in less time

Strengthened compliance

Automation ensures strict adherence to regulatory requirements, including the Uniform Closing Dataset (UCD), reducing compliance risks and improving investor confidence.

Example An automated compliance tool helped a lender increase their audit pass rate by 40%, making their loans more attractive to secondary markets.

Lower operational costs

Automation eliminates manual tasks, significantly reducing labor costs and improving overall operational efficiency.

Example A major lender saved 25% in operational costs after integrating automated tools into their post-closing process.

Enhanced data accuracy

Intelligent Document Processing (IDP) minimizes errors in data extraction, ensuring higher-quality loan files and mitigating risks throughout the loan process.

Example A lender improved data accuracy by 35% with IDP, resulting in more reliable loan files and faster investor approvals.

Increased scalability

With automated systems in place, lenders can easily scale operations to manage higher loan volumes, all while maintaining quality and compliance standards.

Example A national mortgage company doubled its loan capacity using scalable automation, expanding their business while maintaining compliance.

Improved risk management

Automated post-close audits provide deeper insights into loan quality, reducing credit risks and making loans more appealing to investors.

Example An automated risk analysis tool helped a lender reduce bad loans by 20%, increasing loan security and attracting more investor interest.

Ready to enhance your mortgage operations?

Looking to close loans faster, reduce operational costs, and stay compliant? Automation in mortgage lending can help you streamline your processes, improve loan saleability, and increase efficiency.

Reach out to us today to discover how our automated solutions can take your mortgage operations to the next level!