Listen to this blog

Introduction

In the secondary mortgage market, loan saleability and compliance are nonnegotiable. Every deal must stick to underwriting standards and regulations like TRID, not just to stay legal but to keep investor trust intact. Here, due diligence isn’t just a box to check. It’s the backbone of every transaction, verifying borrower credibility and ensuring loans meet the market’s rigid expectations.

But let’s be honest: The market doesn’t make this easy. Constant regulatory tweaks, tech upgrades, and shifting investor demands create bottlenecks. Outdated tools struggle with modern rules, messy data slows reviews, and rushed timelines tempt teams to cut corners. One missed document or misaligned rule can delay sales, spark fines, or sour investor relationships.

To stay ahead, savvy lenders now lean on automation for error spotting, prioritize real world compliance training, and bring in third party reviewers to catch blind spots. The goal? Treat due diligence as the lifeline it is, not paperwork. Because in this market, speed matters, but reliability matters more.

Complex transactions

Modern loan portfolios often include borrowers with intricate financial histories. Evaluating these deals demands more than surface-level assessment. A rigorous review process must uncover hidden risks, verify documentation thoroughly, and ensure full adherence to investor guidelines and regulatory expectations.

Regulatory compliance hurdles

Navigating the industry’s overlapping regulatory requirements—such as TRID, TILA, RESPA, and ATR/QM—can be complex. A single misstep can jeopardize loan legality and investor interest, making compliance an essential component of due diligence rather than a formality.

Technological discrepancies

Many lenders still rely on fragmented or outdated systems for managing due diligence, which leads to workflow inefficiencies, higher operational costs, and delayed closings. These challenges are compounded in high-volume or fast-moving market conditions.

The risks of poor due diligence are well illustrated by the Consumer Financial Protection Bureau’s enforcement actions. Since 2012, the CFPB has issued more than $1.5 billion in penalties related to compliance failures. These figures highlight the very real financial exposure that institutions face when due diligence is rushed or insufficient.

In such a high-stakes landscape, due diligence must evolve from being a reactive compliance activity into a proactive, strategic process. It not only protects lenders from legal and financial risk but also facilitates better execution of secondary market transactions.

Comprehensive due diligence services

At Visionet, we understand that each transaction carries unique risks and requirements. Our due diligence framework is built to adapt. We customize our services for each client engagement to ensure relevance, precision, and speed, ultimately aligning with the business goals of our partners.

Strategic response to industry needs

Visionet is purpose-built to address the most pressing due diligence challenges in the secondary mortgage market. As an approved Third-Party Review (TPR) firm for securitization by all major rating agencies, our role in the transaction lifecycle adds a layer of assurance for all stakeholders involved.

At the heart of our operations is DocVu.AI, an intelligent document processing (IDP) platform that automates document classification, indexing, and data extraction. By embedding AI and machine learning into our workflows, DocVu.AI reduces review time, increases accuracy, and helps teams adapt quickly to changing guidelines and investor expectations.

Complementing our technology is a team of more than 200 due diligence professionals. These domain experts provide unbiased reviews, flag potential issues early, and deliver detailed reports that stand up to regulatory and investor scrutiny. Our blend of automation and human insight ensures that clients receive results that are accurate, timely, and defensible.

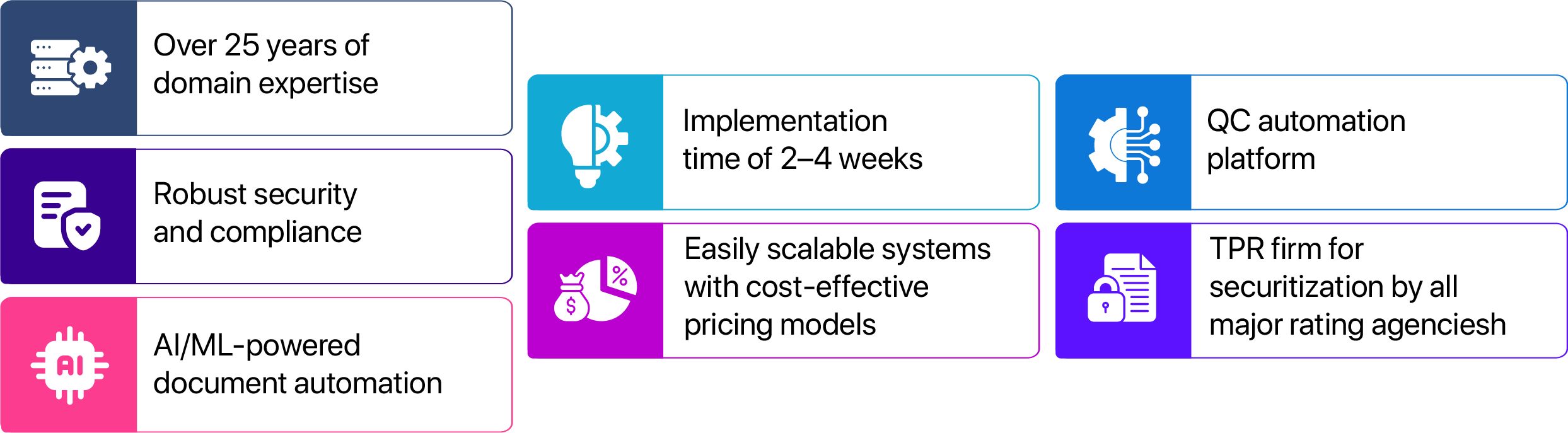

Why Visionet?

Choosing Visionet means gaining a partner with deep industry insight and a commitment to innovation. Our differentiated offering is designed for lenders, investors, and servicers who demand accuracy, speed, and cost efficiency.

Here’s how Visionet stands out:

Visionet’s Answer to Modern Due Diligence

Let’s face it: Today’s secondary mortgage market runs on data and compliance, and stakeholders can’t afford to cut corners. Visionet’s due diligence solutions tackle this head on. As regulations tighten and investor scrutiny grows, outdated methods simply won’t cut it. That’s where smarter strategies come in, AI driven tools paired with human expertise to spot risks, streamline accuracy, and keep investor trust rock solid.

Take DocVu.AI, for example. Teaming up with Visionet’s seasoned review teams, this platform doesn’t just automate paperwork. It transforms how lenders validate loans, turning clunky processes into seamless workflows. The payoff? Faster closings, tighter compliance, and fewer headaches when selling loans downstream. In a market where speed and reliability define winners, this combo isn’t optional. It’s survival.

To stay competitive, lenders need more than spreadsheets and hope. They need partners who merge tech innovation with real world know how. Visionet delivers exactly that, ensuring every loan meets today’s standards while preparing for tomorrow’s curveballs.