Listen to this blog

The COVID-19 pandemic is creating unprecedented disruptions around industries and insurance is not an exception. A pandemic coupled with economic uncertainty poses an opportunity as well as a major challenge to quantify risk and customer engagement for insurance companies. The main reason behind this disruption is the mandatory social distancing measures, signifying that digital transformation is not an optional creative idea anymore but a requirement. It will affect all aspects of the insurance business from underwriting to claims processing. Using rapidly changing alternative data and advanced big data analytics for insurance is no longer a nice-to-have option but will be a strong pillar of the insurance business strategy.

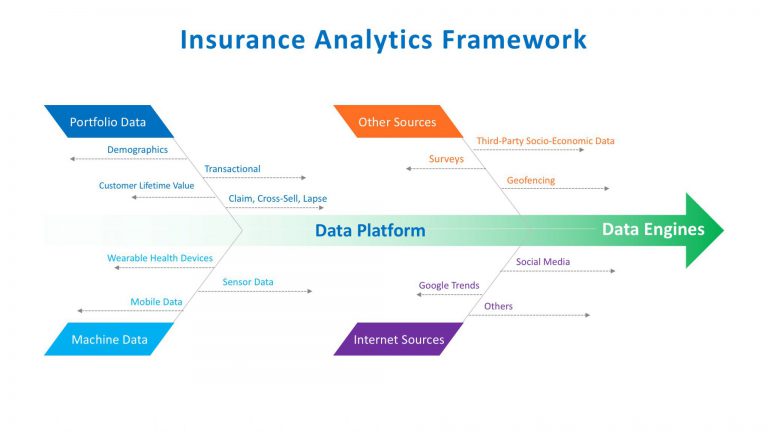

We need Insurance Data Platforms and Data Engines

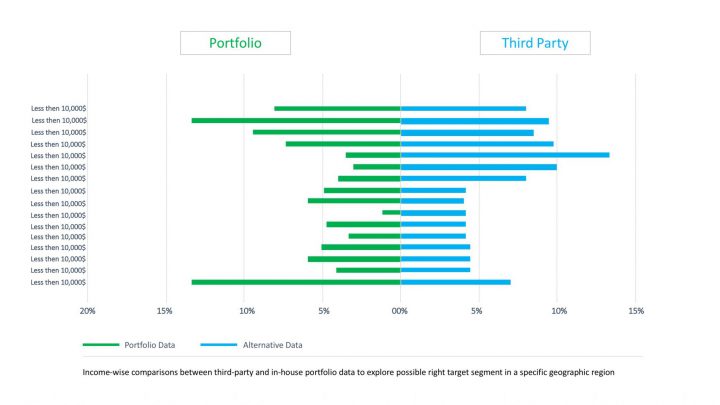

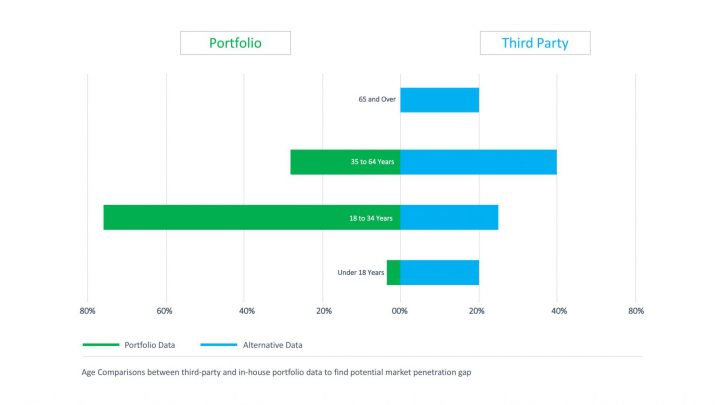

Data management and analytics solutions need to provide a consolidated view of legacy as well as alternative data on multiple levels. Data Engines can harmonize multiple streams of internal and external data and convert to create meaningful insights. They can create the most efficient ways of generating insightful information such as segmented viewing of insurance portfolios, comparison of city-level demographics data or any correlation with Google Trends, Internet of Things and/or macroeconomic trends.

Leveraging third-party portfolio data using Data Engines to identify potential opportunities for penetration, insurance model calibration and contextual social media marketing strategy. For illustrative purpose only.

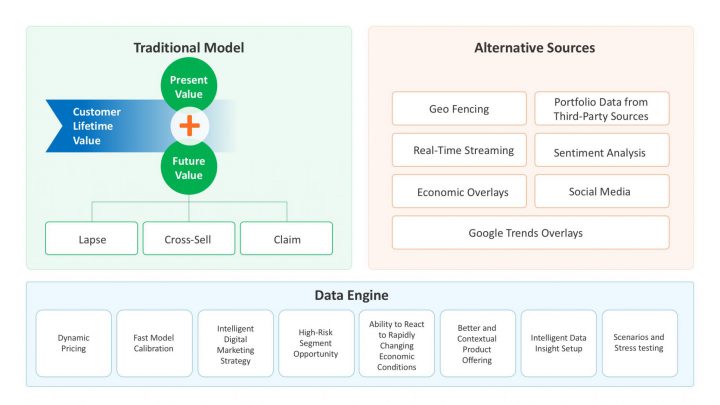

Customer Lifetime Value will be more dynamic and fast calibration is a must

Traditional Customer Lifetime Value (CLV) is calculated using the present value of the customer plus the future potential value of the customer based on claims, lapse and cross-sell ratios with time value of money. In the age of rapid technological changes, CLV also needs to factor in social media analytics, economic conditions, Internet of Things, and search index overlays to develop a more precise analysis. Lapse ratio could be the result of customer dissatisfaction due to poor service or mis-selling. Data platforms can quantify customer call centre conversations by analyzing social media and overall product sentiment. This needs to execute at the customer level.

Revalidation of existing conventional underwriting models using Machine Learning and Artificial Intelligence

Machine Learning models can find the opportunity for dynamic pricing within the high-risk group. For example, the age group of people between 25-30, who are smokers, have no family, having a graduate degree is charged higher premium but claim expense under this segment is low. Based on data we can recommend the option of charging a lower premium within smaller high-risk segments based on geofencing and unique characteristics. Machine Learning can be very instrumental in creating dynamic pricing propositions within specific segments.

The rise of short-term insurance using social media, mobile data and wearable health monitoring devices

Due to the current economic conditions, we anticipate the rise of short-term cover and daily premium charges. This requires a new breed of risk models to work on mobile data, wearable health monitoring devices and other real-time streaming data analytics which is more relevant than ever before. Today’s customers expect total transparency and an exceptional experience at every stage. Big data analytics for insurance companies will enable insightful recommendations to customers based on their personal data so that they can make better decisions regarding their health insurance coverage.

Conclusion

The rapidly changing economic situation in the wake of the new normal requires employing Insurance Data Models with Machine Learning Analytic capabilities as part of an insurance company’s overall business strategy. Insurance companies require streamlined data platforms for a direct data pipeline and data engines to better correlate insurance portfolio data with outside sources. Insurance models need to be recalibrated frequently and customer satisfaction should be quantified through analyzing unstructured data. There will be a strong appetite for short-term low-premium insurance offerings. To adapt to the fast-changing business environment, mobile usage analytics, health monitoring, sensor data along with real-time streaming technologies will need to be leveraged. AI and big data analytics for insurance companies will provide valuable insights into consumer behavior, the ROI of marketing campaigns and more. Instead of Digital Transformation, the new world order is Digital Business which is the key for organizations to survive in the new landscape with smart insights enabled by machine learning.