BankingLens

Driving enriched customer experiences and revenue growth with Visionet’s intelligent support insights solution.

Request a meeting

Banking industry is at a turning point

Current banking challenges

Today’s banking industry faces a wide range of difficulties such as providing personalized services, complying with strict regulatory laws, ensuring cybersecurity, and staying in sync with technological advancements.

The banks of the future are delivering truly seamless multichannel experiences and are constantly identifying new revenue streams to drive business growth. This requires an integrated data ecosystem and insights into the banking products and services.

Navigating the data deluge with BankingLens

Leveraging advanced AI/ML technologies

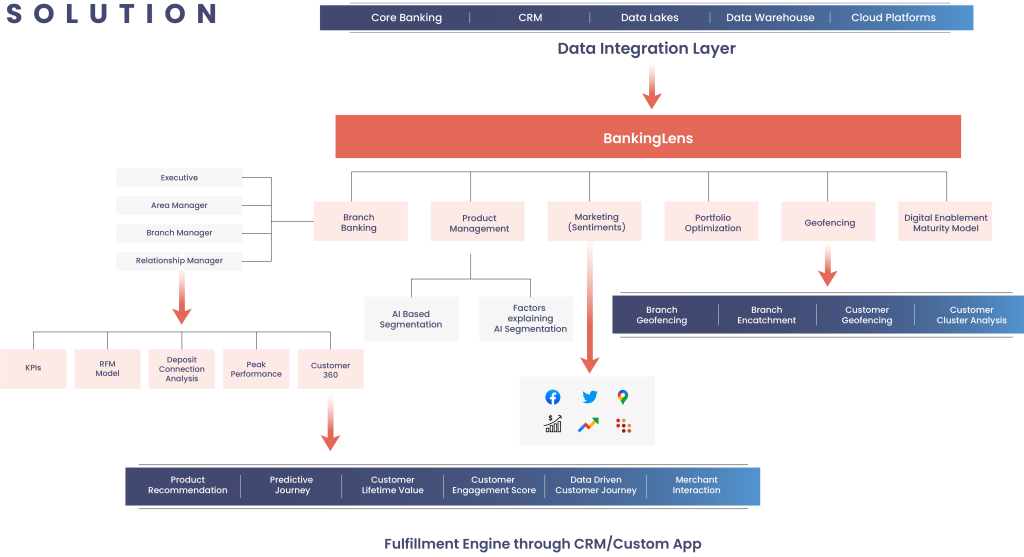

BankingLens is a state-of-the-art data insights solution that uses the power of Artificial Intelligence and Machine Learning to provide early intervention into negative events, optimize business value, and forecast based on historic patterns – enabling better customer service.

Our solution provides meaningful insights into the branch, marketing, and customer-facing operations. It enables banks to identify business challenges in real time and take appropriate actions to extract the desired outcome.

01

Branch banking

We help differentiate and optimize branch operations by using predictive analytics. The insights help assess a branch’s health and enable it to take appropriate action. It also allows banks to track the performance, identify potential target markets, get a 360-customer view, and use the information to close more deals – ultimately, growing the business.

02

Customer 360

BankingLens provides deeper insight into client preferences and intent, which can be used to influence them and achieve the desired results. Our cross-sell and up-sell insights allow banks to combine consumer data from multiple channels such as CRM, mobile, website, social media platforms, and even IoT. It utilizes predictive analytics to map out the products and customer journey, identify the tail customers, and gauge the customers’ lifetime value.

03

Product management

Making the right decisions is a vital part of product and portfolio management for banks. Data mining and machine learning approaches can help identify the right product-market fit and empower banks in rolling out the right products for the right set of customers that are also aligned to the market drivers. Managers and executives can utilize valuable data insights to monitor early signs of budget, cost, and timeline slippages and take corrective actions.

04

Marketing analytics

BankingLens offers a competitive edge to marketers as it allows them to easily manage, mine, and make sense of the vast quantities of customer data, including product purchases, transaction histories, and geofencing preferences for service delivery. Our solution improves each banking channel’s efficacy from acquisition to engagement and beyond, while maximizing the return on investment.

05

Portfolio optimization

Our data insights solution and industry expertise enable banks to meet the desired business requirements and boost portfolio performance. We measure the benefits of diversity across portfolios to identify and help with risk management and active asset allocation – allowing banks to attain higher conversions, enhance customer experience, and scale quickly.

Who can benefit from BankingLens?

Branch executives

Utilize the branch performance insights for faster and more effective deposit mobilization, better risk assessment, and drive more business opportunities.

Marketing executives

Gain access to all sorts of customer and channel data to improve lead conversion and fuel customer growth with omnichannel analytics.

Information technology executives

Run and manage IT better with data consolidation and insights-enabling increased transparency, risk awareness, and alignment with business goals.

Senior management

Get a complete view of the bank performance with dashboards across branches to take executive decisions faster.

Taking banking operations to the next level with Visionet’s BankingLens solution

Automated data extraction

3000+ Multi-disciplinary financial services professionals

Faster implementation and lower TCO

Cloud-native data lake provisioning

Data and KPI-driven dashboards

Pre-built and easily configurable banking KPIs

Pre-built data plugins for multiple sources

Enhanced security

Technology expertise

Contact us