Listen to this blog

Historically, insurance companies have marketed their products to consumers by either employing push strategies or bundling them with other product/service offerings. However, insurance has less penetration in the developing world. Key issues contributing to insurance policy selection include:

- Lack of product knowledge by both insurance agents and consumers

- Low overall awareness about the risk mitigation proposition of insurance

- Inability to understand consumers’ needs

- Absence of data-driven platforms to suit consumer needs

The insurance industry still has a long way to go, and some strenuous efforts are required.

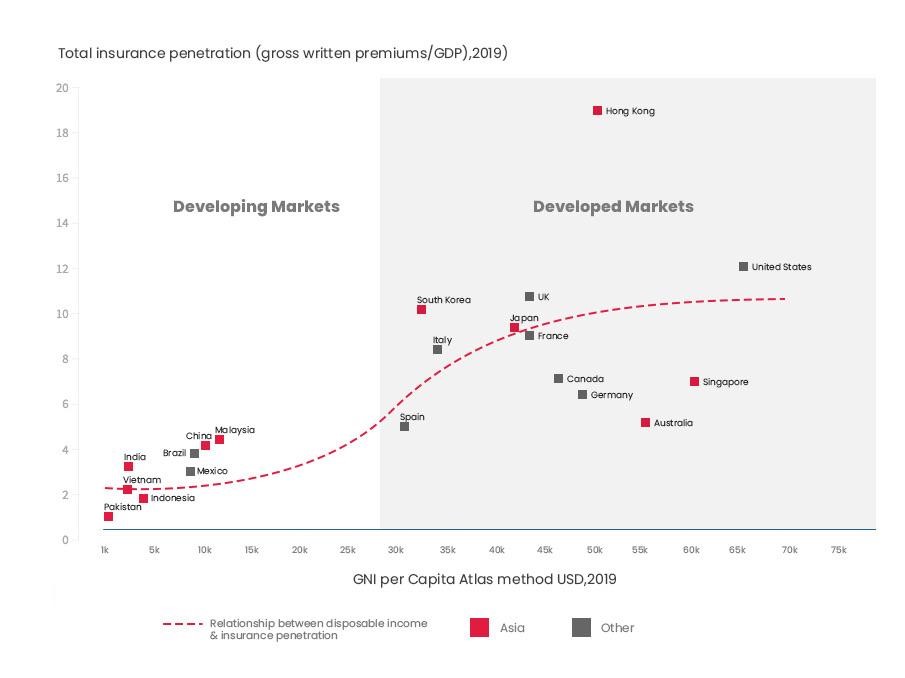

Bain and Company, Making the Most of Asia-Pacific’s Insurance Boom

Interestingly, developing markets exhibit low penetration of insurance when it comes to gross premium as a percentage of GDP. Due to a lot of noise around artificial intelligence in insurance, there is a need for an AI-assisted, custom-developed product – one that would suit individual consumer needs, make insurance policy selection easier, and increase insurance appetite by:

- Personal and intelligent conversable data-driven product advisory framework

- Digital onboarding process with fulfillment engine

- Demonstrating financial health of consumer with intelligent analytical dashboards

Visionet’s Insurance Robo Advisor

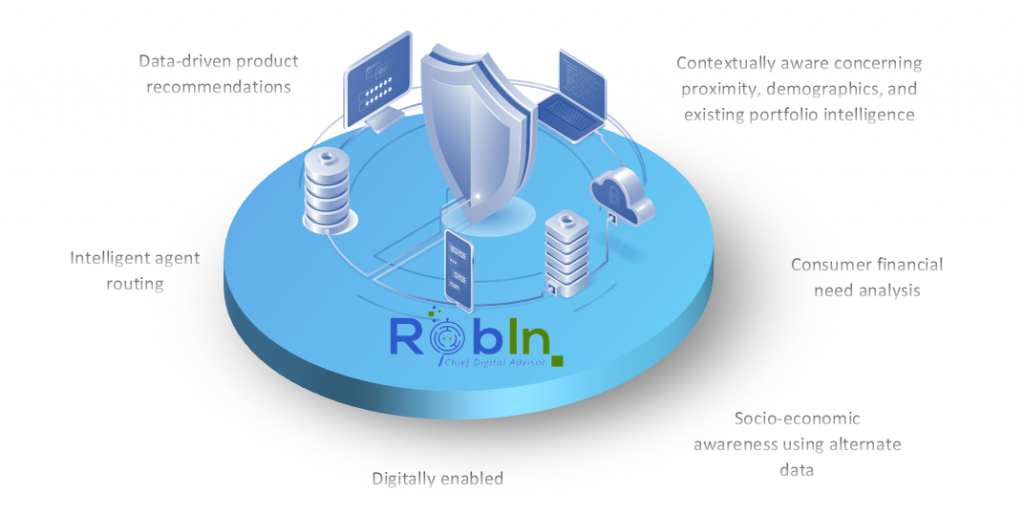

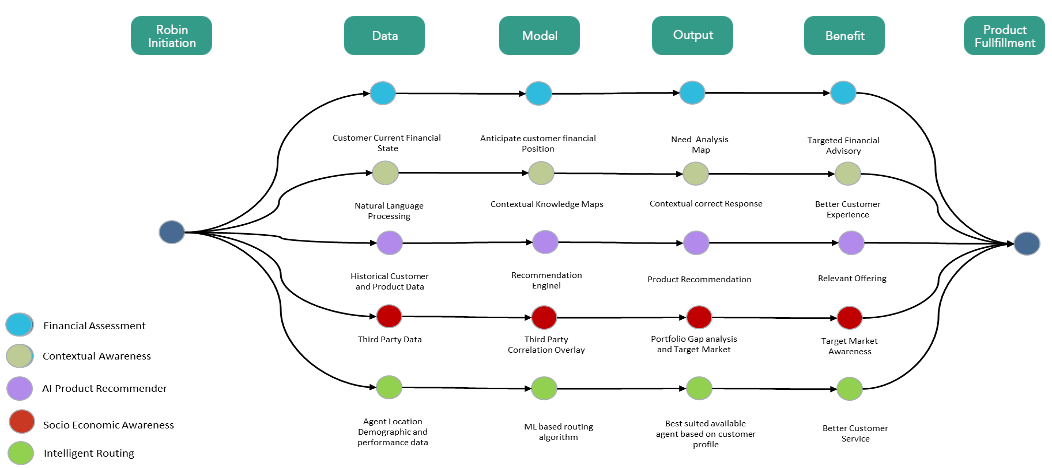

Visionet’s intelligent insurance advisor, RobIn, overcomes these most pressing challenges of the industry. RobIn is an AI-based insurance product selection and fulfillment platform, which streamlines the whole customer journey from the insurance agent’s call to final purchase/subscription by the consumer.

Key capabilities of RobIn

- Data-driven & AI product recommendation engine

- Financial advisory capabilities to accurately understand consumer needs

- Contextually aware analytics help deliver better customer experiences

- Intelligent routing algorithms that connect the best-suited insurance agent advisor with a lead

- Monitor existing customer journeys in real-time and upsell/cross-sell based on individual needs

RobIn Journey

Summary

Insurance companies find it challenging to understand clients’ needs due to a lack of intelligent, data-driven platforms that can streamline the onboarding process, provide valuable financial health insights, and offer data-driven product recommendations. While leveraging artificial intelligence in insurance, Visionet’s RobIn is an insurance selection and fulfillment platform with extensive and advanced capabilities, which can help streamline the entire customer journey.

Author

Sohail Chaudhry – Head of Data Science, Visionet