Listen to this blog

The mortgage industry is evolving rapidly, driven by increased regulatory scrutiny, economic shifts, and the demand for more efficient processes. Traditional due diligence practices rely heavily on manual reviews and fragmented data and are becoming less effective in managing today’s complex loan portfolios. According to Forbes, the growing integration of technology in financial services has significantly improved risk management and operational efficiency. To stay competitive, mortgage lenders must embrace a combination of advanced technology and expert analysis to improve accuracy, reduce risk, and maintain compliance. This blog explores how technology and human insight are shaping the future of mortgage due diligence.

Strengthening compliance checks in due diligence through advanced automation

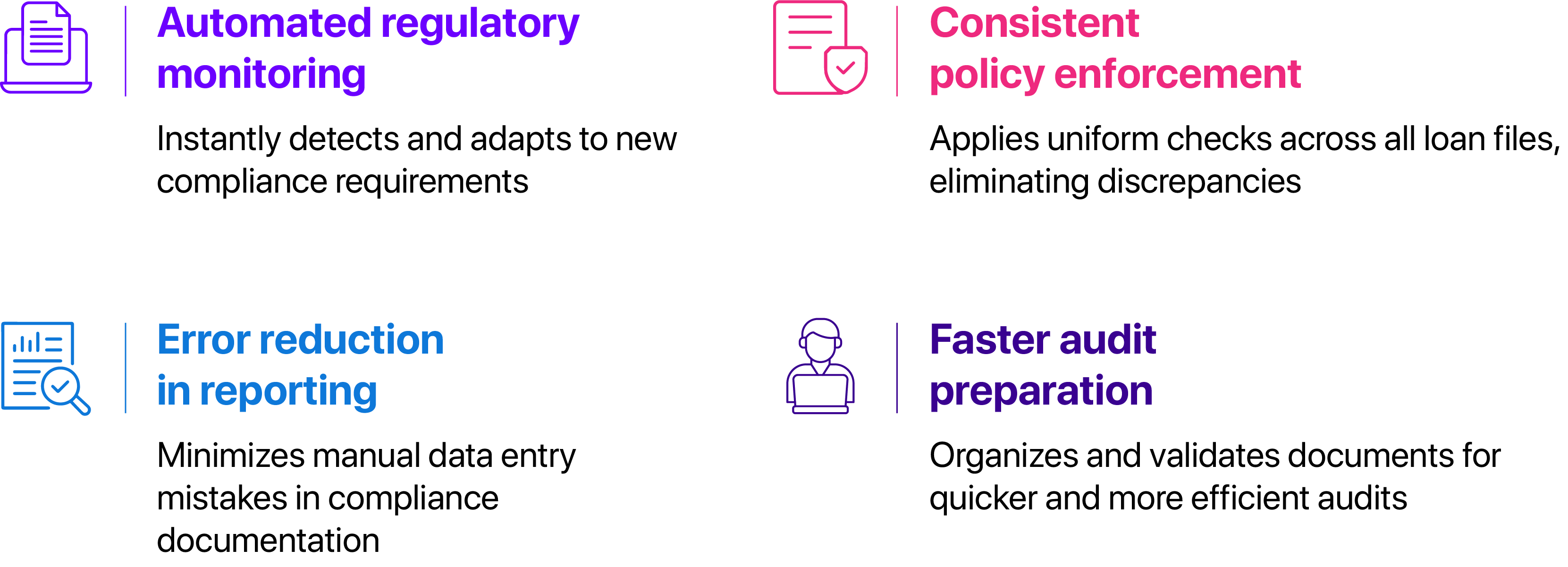

With the increase in legal obligations of the firms dealing in the mortgage industry, it has become very tough to conduct a thorough and accurate compliance check. With manual methods, compliance checks may not be effective in responding to changes in the laws on time, and this may lead to some crucial issues slipping through the cracks only to be met with hefty penalties. Sophisticated automation renders compliance a reliable practice because it enforces strict regulatory functionality, eliminates steps influenced by the human factor, and provides immediate notifications on policy alterations.

Streamlined solutions for compliance management

Maximizing Cost Efficiency through Process Automation

In the competitive mortgage lending landscape, cost efficiency is key for profitability and operational effectiveness. Advanced technologies like automation and AI can greatly reduce manual due diligence costs by streamlining document management, accelerating data extraction, and minimizing human error. This results in faster processing times and lower labor costs. These technological solutions enhance due diligence efficiency, contributing to a healthier bottom line and allowing lenders to allocate resources more effectively and focus on growth opportunities.

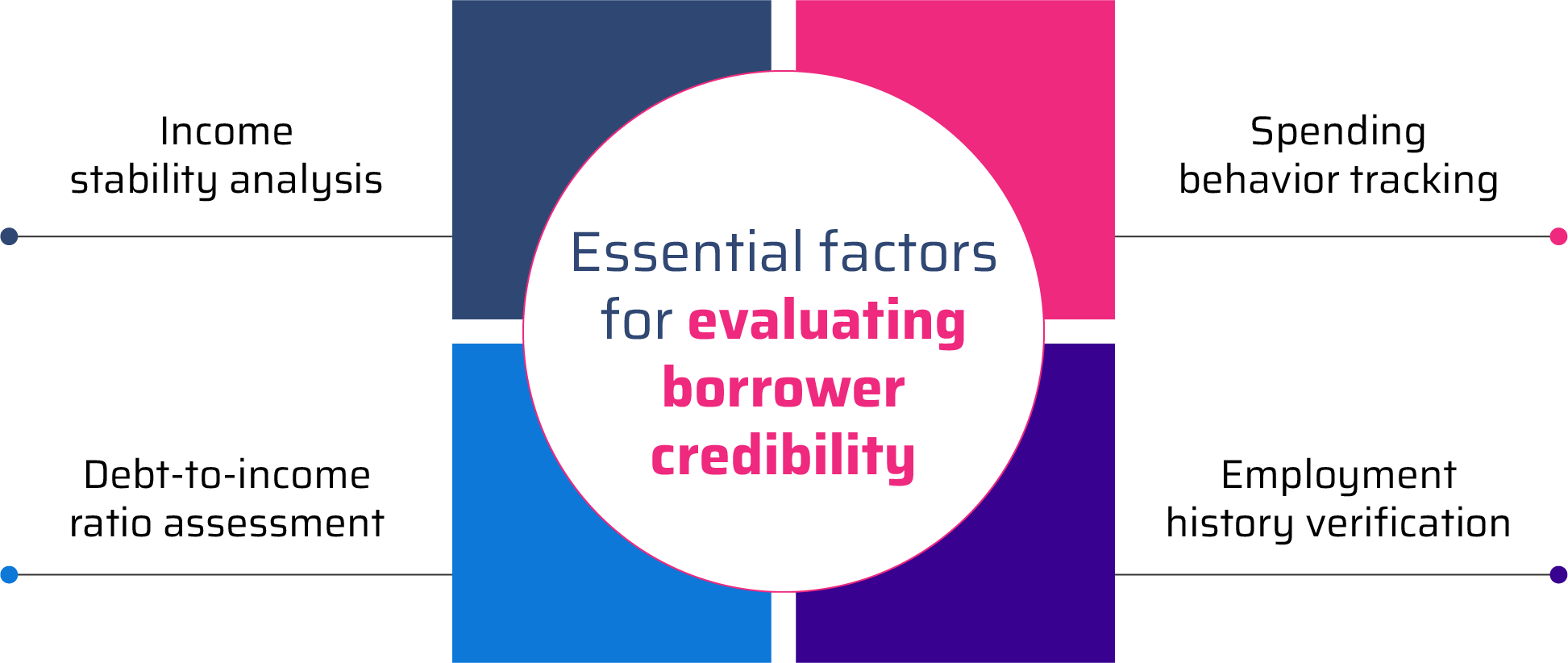

Assessing borrower credibility with data-driven insights

If borrowers' credibility is evaluated solely on credit scores, major factors influencing loan repayment are likely to be overlooked. In this regard, there has been a gradual trend toward the use of data to assess additional aspects such as income level variability, spending patterns, debt-to-income ratios, and employment history. According to the report, using different data sources and using prediction models helps lenders identify dangers that other evaluations may miss. This raises the chances of making the right decision, lowers default rates, and boosts portfolio returns because credit ratings provide an entire picture of the borrower.

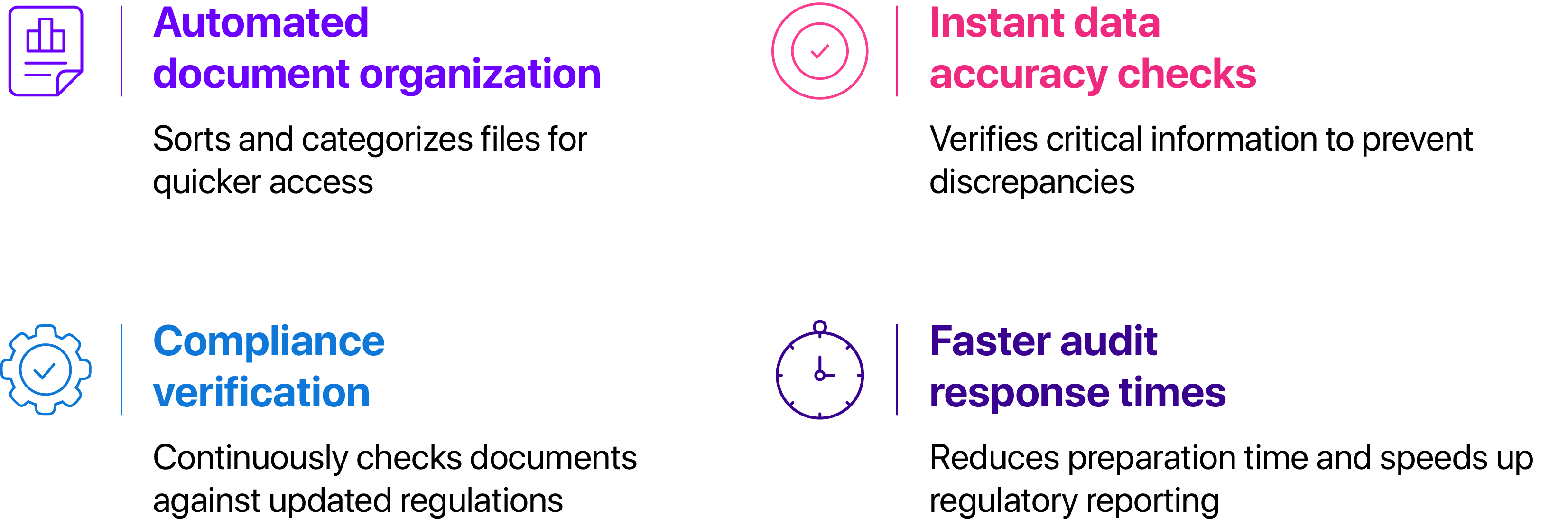

Accelerating audits by 50% through digital validation

Before automation, the mortgage industry's audit preparation process was more involved and only physically verifying data and documents. Through compliance testing, document management, and data quality assurance, digital validation streamlines the entire process. This saves a great deal of preparation time and allows lenders to do audits more quickly while maintaining accuracy and regulatory compliance. To achieve the laws' end date, mortgage firms can improve their audit readiness and lower compliance exceptions and other errors by implementing digital validation solutions.

Impact of digital validation on audit efficiency

Conclusion

The future of mortgage due diligence depends on blending advanced technology with industry expertise. Automation and digital validation streamline compliance checks and audits, reducing risks and improving efficiency. Lenders that adopt these solutions can enhance accuracy, meet regulatory demands, and maintain a competitive edge in the evolving market.