The mortgage industry, a cornerstone of the global economy, has long been a bastion of traditional processes and paperwork. This, coupled with ever-evolving regulatory landscape, creates a complex experience for both lenders and borrowers. Loan applications can get bogged down for weeks, leaving customers frustrated.

However, the advent of GenAI is heralding a new era, one where efficiency, accuracy, and customer satisfaction reign supreme. GenAI has the potential to not only expedite processing but also navigate the intricate web of rules and regulations, ensuring compliance and a smoother experience for all parties involved. Before delving into the transformative potential of GenAI, it is crucial to understand the challenges plaguing the mortgage sector.

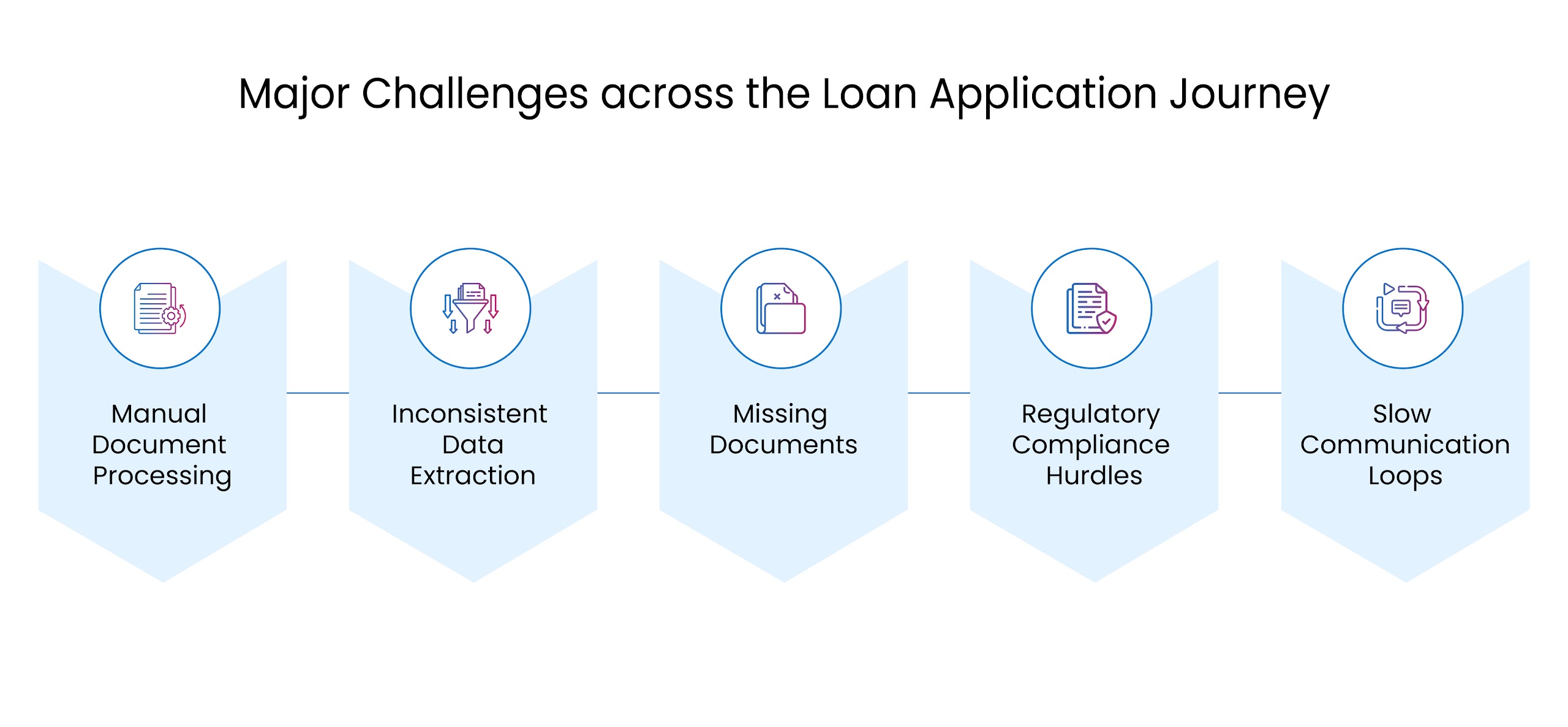

Understanding the Key Challenges

From cumbersome paperwork to regulatory hurdles, the industry faces a multitude of obstacles that can impede progress and profitability. The key challenges include:

- Regulatory Compliance: Navigating the complex web of regulatory requirements is a constant challenge for mortgage lenders. Therefore, automating compliance checks and ensuring adherence to regulations, thereby reducing the risk of penalties and legal issues, can make a significant difference in operational efficiency and regulatory alignment.

- Data Security: With sensitive financial information at stake, maintaining robust data security measures is non-negotiable. Automated systems can bolster cybersecurity defenses, detect anomalies, and prevent data breaches, instilling confidence in customers and regulators alike.

- Customer Experience: In today’s fast-paced world, customers expect seamless and personalized experiences. With the help of analyzing customer data, one can offer tailored mortgage solutions, anticipate needs, and enhance overall customer satisfaction.

The GenAI Advantage

GenAI, bolstered by advanced algorithms and machine learning capabilities, offers a plethora of benefits that can revolutionize the mortgage industry value chain:

- Accelerated Loan Processing: By automating tedious tasks such as document verification, data entry, and credit scoring, GenAI accelerates the loan processing timeline. This not only reduces operational costs but also expedites the approval process.

- Predictive Analytics: GenAI leverages predictive analytics to assess borrower risk profiles, predict market trends, and optimize lending strategies. This data-driven approach enables lenders to make informed decisions, mitigate risks, and maximize profitability.

- Seamless Communication: Effective communication is paramount in the mortgage journey. GenAI-powered chatbots and virtual assistants provide round-the-clock support, answer queries, and guide customers through each stage of the application process, fostering trust and transparency.

The Visionet Edge: Our Key GenAI Offerings

Visionet offers a comprehensive end-to-end mortgage solution powered by GenAI, which spans mortgage origination, valuation, title and settlement, and loan servicing. Our suite of GenAI solutions is crafted to streamline your mortgage processing journey, cutting down on operational costs, while maintaining a steadfast commitment to delivering exceptional service to your clients. Our GenAI Consulting service is tailored to your needs within the mortgage sector, providing personalized use cases and leveraging solutions from leading hyperscalers. We meticulously assist in data preparation and the creation of customer foundation models, fine-tuning large language models (LLMs) to perfection to suit your industry requirements.

Additionally, we tailor the GenAI platform to your specific needs. This includes developing a comprehensive platform blueprint, building the application development toolchain, establishing efficient vector databases, and handling the deployment, monitoring, and optimization of Large Language Models (LLMs) for optimal performance.

Furthermore, our expertise extends to crafting customized applications that align seamlessly with your business data. We also excel in developing AI bots and implementing advanced knowledge management systems, ensuring optimal performance and integration within your operations.

A Case in Point

In recent times, numerous industry players have already embraced GenAI with remarkable results. For instance, when a large mortgage service provider, being a new entrant in this space, was looking for a partner to assist in faster onboarding, they considered Visionet’s Gen AI capabilities, as the most preferred one, resulting in remarkable outcomes.

First of all, a customized solution comprising automated document classification along with automated data extraction and reconciliation was provided that became a game changer.

Within a short period of time, a 25% reduction in turnaround time was observed, along with a 30% reduction in the loan boarding timeline.

As a result, the mortgage servicing company experienced a 40% increase in productivity while service quality delivery achieved near-perfect accuracy, hovering around 90%.

Future Trends and Opportunities

Looking ahead, the future of the mortgage industry is intrinsically linked to GenAI and other emerging technologies. Here are the key trends to watch:

Blockchain Integration: Combining GenAI with blockchain technology can revolutionize mortgage asset management, enhance transparency, and streamline transactions.

Personalized Mortgage Products: GenAI-driven analytics can personalize mortgage products based on individual financial profiles, preferences, and risk appetites, catering to diverse customer segments more effectively.

- Enhanced Risk Management: GenAI’s predictive capabilities can bolster risk management strategies, identify potential defaults or frauds early, and proactively mitigate financial risks.

Conclusion

GenAI is not just a technological tool; it catalyzes change, innovation, and progress in the mortgage industry. Leveraging its power unlocks new opportunities, enhances operational efficiencies, and delivers unmatched value to customers. Embracing GenAI is not optional but essential for navigating the evolving mortgage lending landscape.

Partnering with Visionet empowers you to unlock heightened efficiency and customer satisfaction in mortgage operations. Our holistic solutions streamline processes, cut costs, and elevate service quality.

Connect with our experts to elevate efficiency and customer satisfaction in your mortgage operations and experience the transformative power of GenAI in mortgage processing.